The Best Ryzen Motherboards for Overclocking (X370 & B350 AM4) | GamersNexus - Gaming PC Builds & Hardware Benchmarks

Amazon.com: Micro Center AMD Ryzen 7 5700X 8-Core 16-Thread Unlocked Desktop Processor Bundle with MSI B550-A PRO ProSeries Motherboard (AMD AM4, DDR4, PCIe 4.0, SATA 6Gb/s, M.2, USB 3.2 Gen 2 ATX) :

MSI MAG B650M MORTAR WIFI AM5 AMD B650 SATA 6Gb/s DDR5 Ryzen 7000 Micro ATX Motherboard - Newegg.com

Msi Meg X399 Creation Motherboard Amd / Tr4 Interfacee- Atx Motherboard Overclocking Gaming Motherboard - Buy E-atx Motherboard,Amd X399/socket Tr4 Motherboard,Msi Gaming Motherboard Product on Alibaba.com

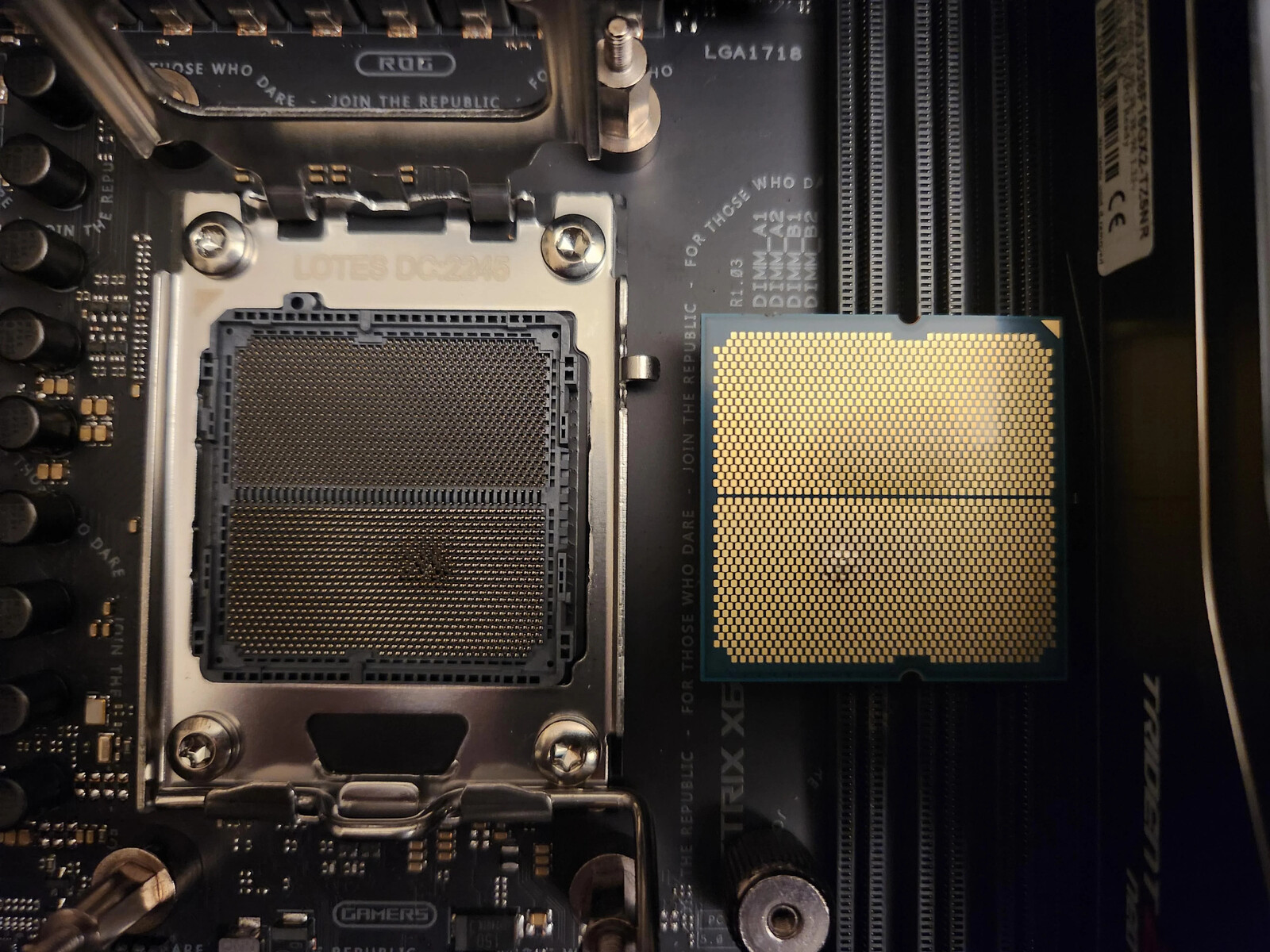

The Best Ryzen Motherboards for Overclocking (X370 & B350 AM4) | GamersNexus - Gaming PC Builds & Hardware Benchmarks

The Best Ryzen Motherboards for Overclocking (X370 & B350 AM4) | GamersNexus - Gaming PC Builds & Hardware Benchmarks

Amazon.com: Velztorm AMD Ryzen Threadripper PRO 5975WX 32-Core 64-Thread Unlocked Desktop/Workstation Processor Bundle with Asrock WRX80 Creator Motherboard (E-ATX, 7 PCIe 4.0 x16, WiFi 6E, Thunderbolt 4) : Electronics

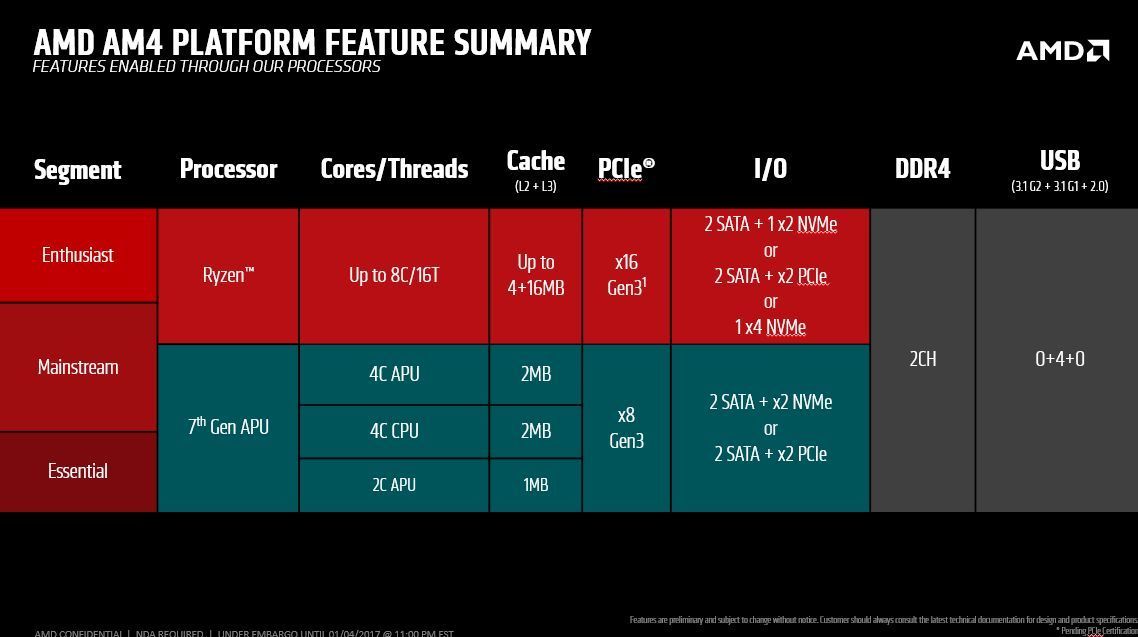

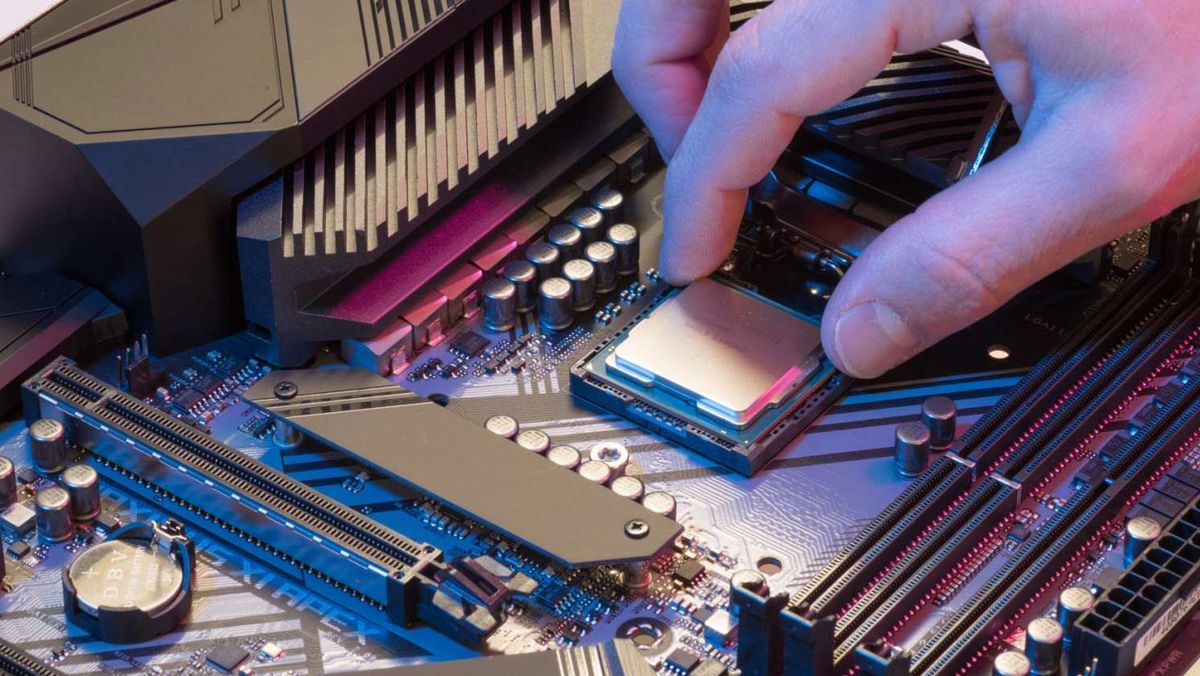

AMD Ryzen 7000X3D Processors Prone to Physical Damage with Voltage-assisted Overclocking, Motherboard Vendors Rush BIOS Updates with Voltage Limiters | TechPowerUp

EVGA X570 DARK Pictured In Detail, One of The Most Powerful AMD Ryzen AM4 Overclocking Motherboard To Date

![TPU] AMD Asks Motherboard Makers to Remove Overclocking Options for Ryzen 7 5800X3D : r/hardware TPU] AMD Asks Motherboard Makers to Remove Overclocking Options for Ryzen 7 5800X3D : r/hardware](https://external-preview.redd.it/9ILc1W8iC7iHNTgOm8gTBJg64Ojs3vSschEiYceYYt0.jpg?width=640&crop=smart&auto=webp&s=32e00691d4d429a953f7f94d0e94c5e1fedb95ea)